DBS is one of the few banks in Singapore still offering safe deposit boxes to retail customers. Unlike OCBC and UOB, which limit access to premier banking clients, DBS allows rental with a basic savings or current account, making it the most accessible bank option.

However, access is limited to banking hours, and contents are not insured by the bank. Private automated vaults provide greater flexibility and security for those needing 24/7 access and flexible plans.

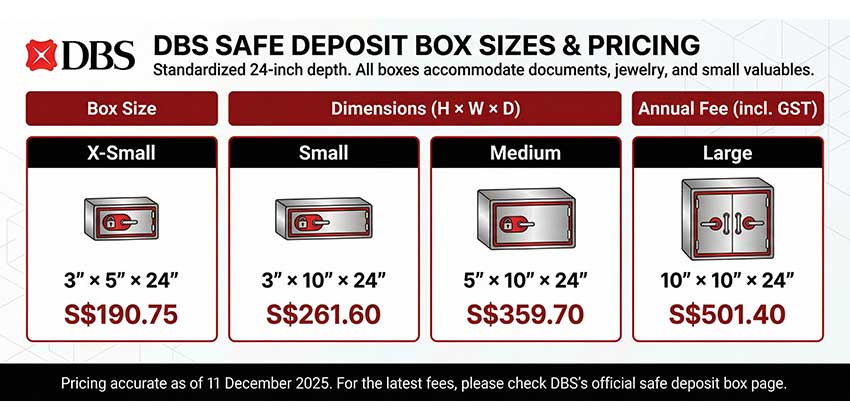

DBS Safe Deposit Box Sizes and Fees

DBS offers four box sizes with standardized 24-inch depth. All boxes accommodate documents, jewelry, and small valuables.

| Box Size | Dimensions (H × W × D) | Annual Fee (incl. GST) |

| X-Small | 3" × 5" × 24" | S$190.75 |

| Small | 3" × 10" × 24" | S$261.60 |

| Medium | 5" × 10" × 24" | S$359.70 |

| Large | 10" × 10" × 24" | S$501.40 |

Pricing accurate as of 11 December 2025. For the latest fees, please check DBS's official safe deposit box page.

The fees include Singapore's 9% GST. DBS requires annual payment upfront with a minimum one-year commitment. No key deposit is required.

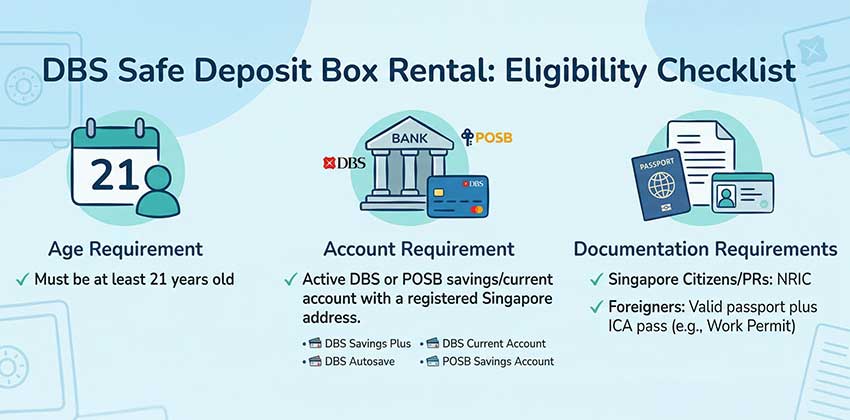

Requirements to Rent a DBS Safe Deposit Box

To rent a DBS safe deposit box, applicants must meet three core eligibility criteria:

Age Requirement: Must be at least 21 years old

Account Requirement: Active DBS or POSB savings or current account with registered Singapore address

Documentation Requirements:

- Singapore Citizens/PRs: NRIC

- Foreigners: Valid passport plus ICA pass (Employment Pass, Work Permit, Dependent Pass, Student Pass, or Long-Term Visit Pass)

Qualifying accounts include DBS Savings Plus, DBS Autosave, DBS Current Account, or POSB Savings Account.

How to Apply for a DBS Safe Deposit Box

Applications are processed in-person only at branches with safe deposit facilities.

Application Steps:

- Visit a DBS branch offering safe deposit boxes

- Present identification documents

- Select available box size

- Complete application forms

- Pay annual rental fee

- Receive box keys

Processing completes during a single visit. Box availability varies significantly by location. Popular branches often have long waiting lists.

Access Hours and Key Limitations

Access is restricted to banking hours only:

Weekdays: Monday to Friday, 8:30am to 4:00pm

Saturdays: 8:30am to 12:30pm

Closed: Sundays and public holidays

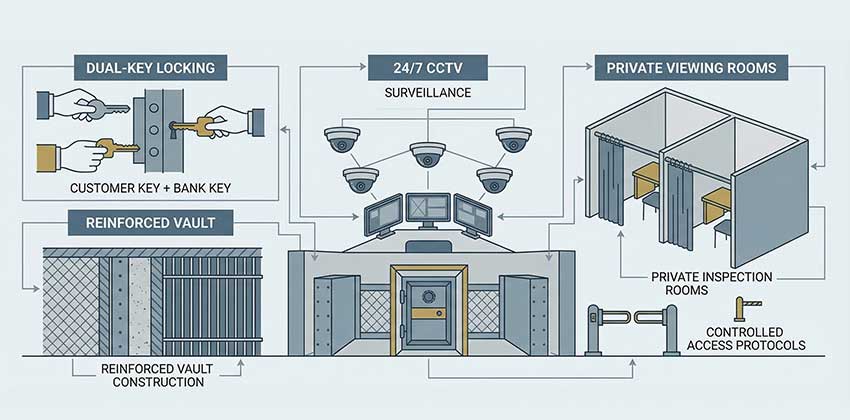

A dual-key system requires bank staff presence for access in private viewing rooms. These hours can inconvenience working professionals or those needing urgent retrieval.

Security Features at DBS Safe Deposit Boxes

Applications are processed in-person only at branches with safe deposit facilities.

Application Steps:

- Visit a DBS branch offering safe deposit boxes

- Present identification documents

- Select available box size

- Complete application forms

- Pay annual rental fee

- Receive box keys

Processing completes during a single visit, though availability is a key consideration. Box availability varies significantly by location, with popular branches often maintaining long waiting lists. Customers report waiting periods extending several months at high-demand locations.

Critical Considerations Before Renting

- No Insurance: Contents are stored at customer's risk (standard across Singapore banks). Arrange separate coverage if needed.

- Prohibited Items: Liquids, perishables, explosives, hazardous materials, illegal items, or living organisms.

- Estate Settlement: Requires Grant of Probate or Letters of Administration; joint access freezes upon death notification until resolved.

- Termination/Arrears: DBS may refuse access or force-open for unpaid fees; early termination offers limited refunds.

DBS vs Other Bank Safe Deposit Boxes in Singapore

DBS offers the best accessibility among major banks. However, all three banks share common limitations: restricted access hours, no content insurance, and dependence on banking operations.

| Feature | DBS | OCBC | UOB |

| Eligibility | Regular account holders | Premier Banking only (S$200k min) | Premier Banking primarily (S$350k min) |

| Small Box Fee | S$261.60/year | ~S$221/year | ~S$256.80/year |

| Key Deposit | None | S$150 | Varies |

| Branch Locations | 8 branches | 6 branches | Limited |

| Access Hours | Banking hours only | Banking hours only | Banking hours only |

| Content Insurance | Not included | Not included | Not included |

The table reveals an industry-wide pattern: banks provide basic secure storage but lack the flexibility and customer-centric features that modern life demands.

Best Alternative: Private Automated Safe Deposit Box Providers : such as STARVAULT

STARVAULT offers a modern, independent alternative with enhanced features.

Key Advantages :

- 24/7 Access: Available 365 days a year, including evenings, weekends, and holidays.

- No Banking Relationship Required: Open to all (locals, PRs, foreigners); only phone/email for OTP verification is required.

- Multi-layered Security: Facial recognition, card, fingerprint, PIN, and physical key; staff-free design with 24/7 CCTV, on-site guard, and alarms.

- Access Notification: receive email notifications with realtime timestamps whenever your Box is accessed

- Disaster Protection: Gas suppression fire system (no water damage); elevated location; reinforced concrete vault construction.

- Administrative Control: OTP verification is required for administrative changes.

- Flexible Terms: Monthly rentals from one month.

STARVAULT Pricing Comparison

| Box Size | Monthly Fee | Annual Fee (12 months) | DBS Equivalent Annual |

| Small | S$30 | S$360 | S$261.60 |

| Medium | S$66 | S$792 | S$359.70 |

While STARVAULT's annual fees are slightly higher than DBS, the pricing reflects comprehensive service advantages: 24/7 access, enhanced security, complete banking independence, flexible contracts, and superior disaster protection. For many customers, these benefits justify the cost difference, particularly when factoring in the convenience value and avoided opportunity costs of restricted bank hours.

Free Will Custodian Service

Complimentary storage with streamlined executor access, avoiding bank probate delays.

Which Option Is Right for You?

| Choose DBS If You... | Choose STARVAULT If You... |

| Prioritize lowest annual cost | Need 24/7 flexible access |

| Only need access during banking hours | Want enhanced security features |

| Already maintain a DBS/POSB account | Require no banking relationship |

| Prefer traditional bank infrastructure | Value administrative control and modern technology |

| Can plan access during weekday business hours | Need short-term rental flexibility |

Conclusion

DBS provides competitive, accessible safe deposit boxes with annual fees from S$190.75 to S$501.40. Limitations include restricted hours, variable availability, and annual commitments.

STARVAULT addresses these with round-the-clock access, advanced security, independence from banks, and flexible terms—ideal for convenience and protection.

Schedule a tour or get a personalized quote from STARVAULT today.